Climate change poses a risk to assets, infrastructure and business continuity.

We are already seeing the effects: in the UK, sea levels are already about 17cm higher than the pre-industrial baseline, and nine of the ten warmest years on record have occurred since 2002. Climate projections warn that these effects will get worse, with all credible scenarios showing dramatic impacts over the next 30 years.

By 2050 (in the UK):

- What is today a 1/100 year extreme sea level event will occur at least once a year

- Sea levels could rise by up to 40cm

- The average summer is likely be as hot as 2018, currently the hottest on record

- We will see more severe, more frequent flooding.

This could mean excessive service outage, supply chain disruption, rising costs and potentially early obsolescence.

Furthermore, by 2050 the UK should be net zero. Low carbon business models will thrive, emitting carbon will incur cost.

The Government has signalled that all listed companies and large asset owners will be required to disclose their financial exposure to climate risk by 2022.

Do you understand your organisation's resilience and vulnerability?

Frazer-Nash can help you understand and reduce your exposure to these risks. We apply our deep expertise in sustainability and systems engineering, innovation and business transformation to develop solutions that work.

The flipside of every risk is an opportunity. We actively look for climate adaptation solutions that deliver additional benefits. For example, re-engineering for resilience can reduce exposure to other risks, improve efficiency or even create new sources of revenue.

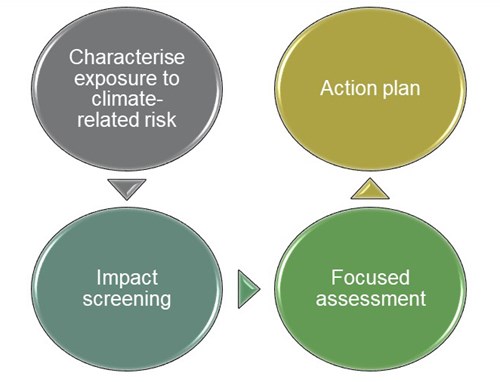

Our approach - from understanding to action

The first step is to understand how climate change could impact your organisation. We have developed our climate impact screening methodology to assess the risks and opportunities for your organisation. This involves a facilitated workshop involving key organisational stakeholders and subject matter experts from Frazer-Nash with practical experience in leading FTSE100 companies.

Building on the approach set out by the Taskforce for Climate-related Financial Disclosures (TCFD), we look at physical and transition impacts using a bespoke climate risk framework.

Building on the approach set out by the Taskforce for Climate-related Financial Disclosures (TCFD), we look at physical and transition impacts using a bespoke climate risk framework.

We then design the next stages according to your needs. This may include, for example:

- Scenario analysis using latest Met Office (UKCP) data to help understand and communicate the impacts that climate change could have on your organisation

- Evaluating financial exposure to climate risks

- Analysis of structures, mechanical components or supply chains

- Design validation to help you demonstrate resilience over the applicable range of future climatic conditions

- Modelling networks to identify pinch points

- Creating a digital twin of your organisation to explore alternative options in a virtual environment

- Multi-criteria decision analysis to inform climate resilience planning

- Evaluation of the socio-economic impacts of alternative scenarios including, for example, extended service outage.

Image: Dawlish railway line and sea wall destroyed by the sea, 2014

Image: Dawlish railway line and sea wall destroyed by the sea, 2014

Sources:

- Intergovernmental Panel on Climate Change (IPCC) scenarios RCP 2.6, 4.5, 6.0 and 8.5

- Met Office

- BEIS Green Finance Strategy, July 2019